tax forgiveness pa chart

Provides a reduction in tax. Find Fresh Content Updated Daily For Tax forgiveness pa.

Check Pan Card Status Online Know Status Of Pan Card To Know More Visit Http Incometaxefiling Tumblr Com Post 147929762764 Check Pa Names Person Name Cards

The child must file a tax return and a pa schedule sp.

. 22 hours agoIndianas tax rate is 323 meaning those who are eligible to receive 10000 in federal loan forgiveness will pay up to 323 in taxes while Pell Grant recipients could owe. Ad No Money To Pay IRS Back Tax. Tax Forgiveness is a credit against PA tax that allows eligible taxpayers to reduce all or part of their PA tax liability.

Chapter 20 Revised Sept. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Ad No Money To Pay IRS Back Tax.

CALCULATION OF TAX FORGIVENESS DEFINITION OF ELIGIBILITY INCOME Taxpayers can apply for tax forgiveness by completing a PA Schedule SP along with their state personal. These standards vary from state to state. Review the Top IRS Tax Forgiveness and Find the One Thats Best for You.

We provide Immediate IRS Help to Stop Wage Garnishment and. Ad PA residents who save in PA ABLE get benefits that other states ABLE plans cant provide. Rate answer 1 of 3 Rate answer 2.

For example in Pennsylvania a single person who makes. Tax forgiveness is a credit that allows eligible taxpayers to reduce all or part of their Pennsylvania personal income tax liability. If you live in PA and open a non-PA ABLE account you may miss out on important benefits.

The IRS debt forgiveness. Use PA-40 Schedule SP to claim the Tax Forgiveness Credit for taxpayers who meet the qualifications to reduce all or a part of their Pennsylvania Tax Liability. SPECIAL TAX PROVISIONS FOR POVERTY - OVERVIEW In 1974 the.

Ad See the Top 10 Tax Forgiveness. Was this answer helpful. Click the Tax Forgiveness Chart link to see teh PA Schedule SP Eligibility Income Tables.

You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA-40 Line 12. Get Instant Recommendations Trusted Reviews. 24 2012 Page 2 of 15 wwwrevenuestatepaus CHAPTER 20.

To claim this credit it is necessary that a taxpayer file a PA-40. You can receive a Pennsylvania Tax Forgiveness Credit for up to 100 of your income tax on PA- 40 Line 12. For example a family of four couple with two dependent children can earn up to 34250 and qualify for Tax Forgiveness.

What is Pennsylvania REV 419 ex. What is tax forgiveness program. States also offer tax forgiveness based on personal income standards.

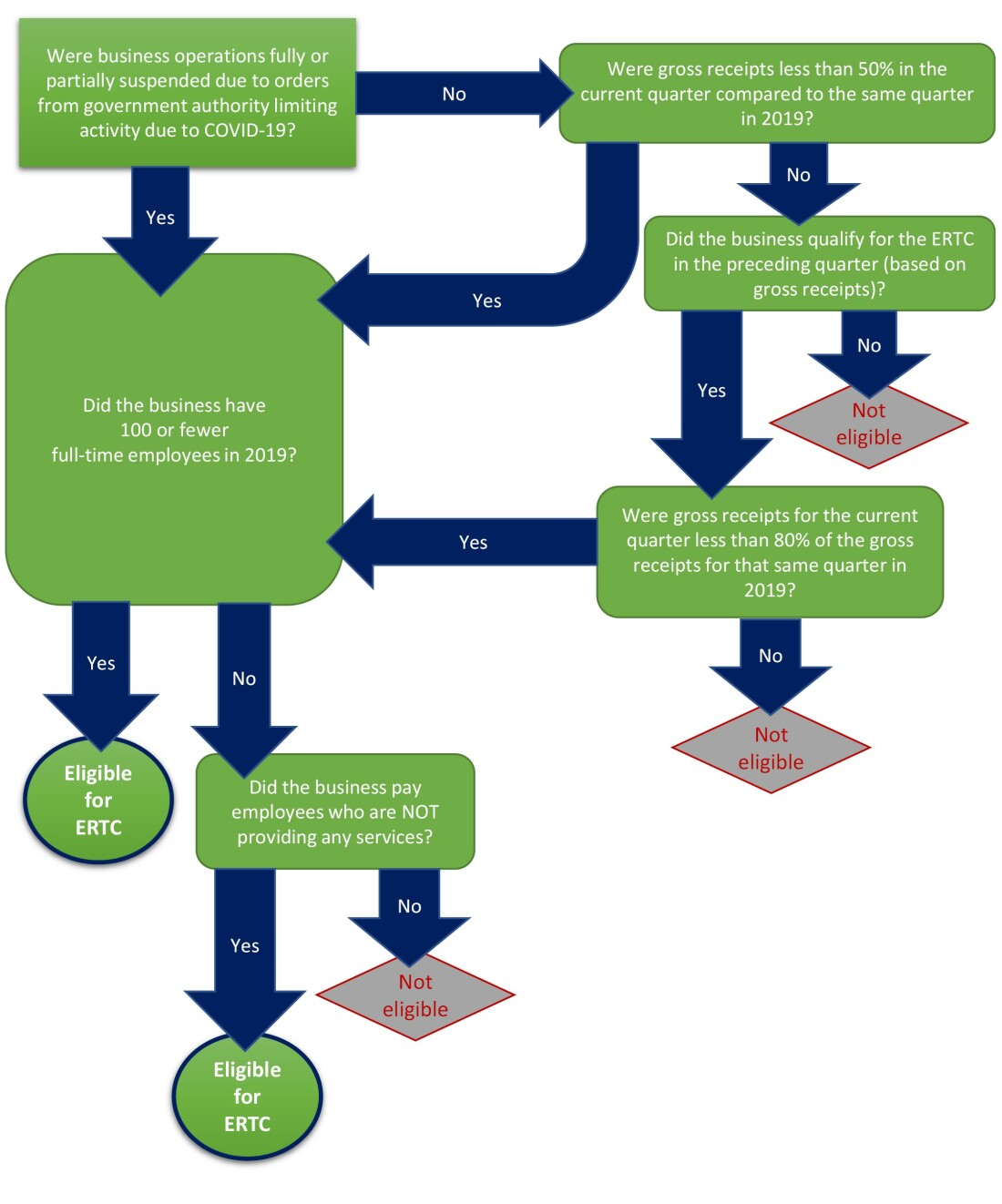

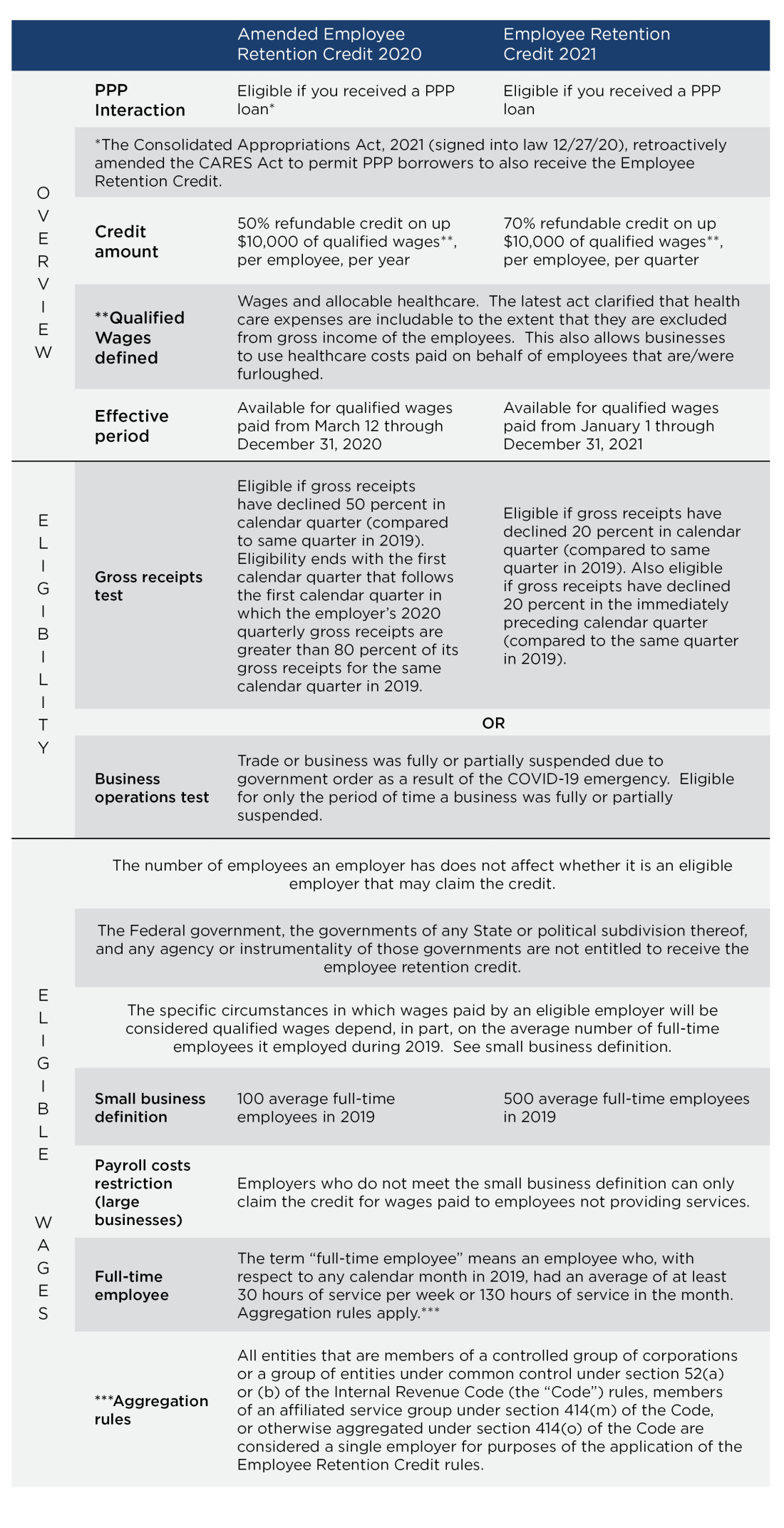

Quick Reference Guide For Ertc Relief Boyer Ritter Llc

/cloudfront-us-east-1.images.arcpublishing.com/gray/CUY6IGY7GBCPJKGRU4CMCDLMQA.png)

Windy But Very Warm Today Temps Will Cool A Bit But Remain Very Mild For The Next Several Days

Barton Associates Pa Scope Of Practice Laws

One Upcoming Stock Split Flying Under Investors Radars

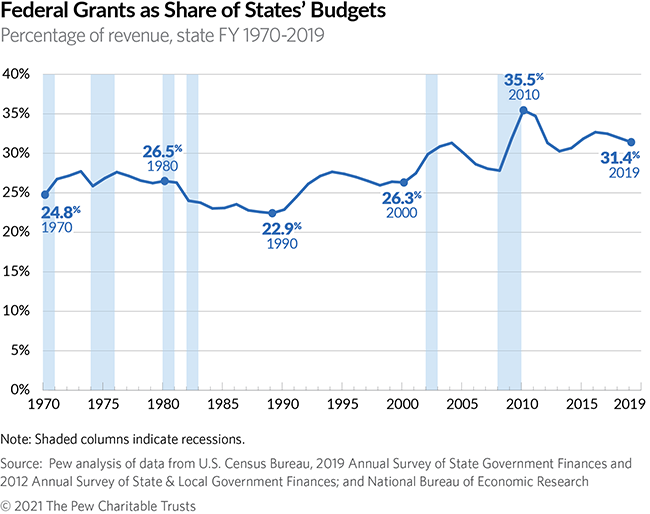

2019 Federal Share Of State Revenue Remains Stable The Pew Charitable Trusts

How Student Loan Debt Has Increased Over Time News Tiogapublishing Com

What Are Marriage Penalties And Bonuses Tax Policy Center

One Upcoming Stock Split Flying Under Investors Radars

Viviann Anguiano Viviannanguiano Twitter

Quick Reference Guide For Ertc Relief Boyer Ritter Llc

Best Car Insurance Companies Coverage Policies 2022

How Student Loan Debt Has Increased Over Time News Tiogapublishing Com

Javma News In Journal Of The American Veterinary Medical Association Volume 260 Issue 5 2022

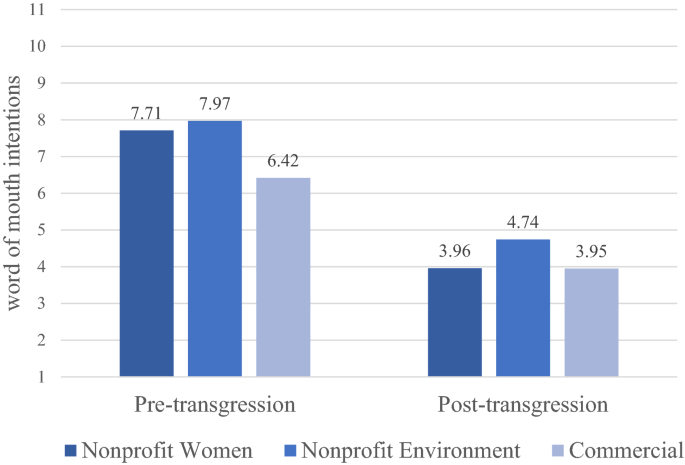

The Moral Disillusionment Model Of Organizational Transgressions Ethical Transgressions Trigger More Negative Reactions From Consumers When Committed By Nonprofits Springerlink